irs tax levy program

STOP YOUR BANK LEVY. Use the TAS Qualifier Tool.

Irs Tax Levy Tax Law Offices Of David W Klasing

If you dont pay or make arrangements to settle your tax debt the IRS can levy seize and sell any type of real or personal property that you own or have an interest in.

. Valid for 2017 personal income tax return only. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Find out if TAS can help you with your tax issue.

Get help from a Low. Participate in the Offer in Compromise program. Ad Fill Out Our Form Find Out Free If Eligible For IRS Tax Debt Relief Fresh Start Program.

The main example is the. Certain federal payments OPM SSA federal employee salaries and federal employee travel disbursed by the Department of the Treasury Bureau of Fiscal Service BFS may be subject to. Status of the Taxpayer Levy 0617 01102018 Form 15103 SP Form 1040 Return Delinquency Spanish Version.

No Fee Unless We Can Help. Ad Remove IRS State Tax Levies. Reduce Or Completely Eliminate Your Tax Debt.

Available at participating offices and if your employers participate in the W-2 Early AccessSM program. Free IRS tax preparation assistance for qualifying taxpayers. The IRS has a master record of all W2s 1099s.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Whereas a lien secures the governments interest in your property a levy actually. Many taxpayers simply havent filed one or more past tax returns.

CPA Master Tax X-IRS Agent 28 Yrs Exp Can Help. Get Your Free Tax Review. Because the IRS hardship program requires the disclosure of very sensitive financial records.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Speak With A Proven Trusted Screened IRS Levy Specialist Now To Get Your Levy Released. Transmittal Schedule Form 5500-EZ Delinquent Filer Penalty Relief.

The IRS has many programs to help taxpayers pay their tax debt when they have little or no money. Get professional tax relief help now. Ad IRS Tax Levy Help Is A Phone Call Away.

Our IRS tax attorney experts have saved our clients hundreds of thousands of. This is one of the first ways to get into compliance with the IRS. Do not take on the IRS or State by yourself.

Complete Edit or Print Tax Forms Instantly. UConn Taxpayer Representation Online Training Program The School of Business at the University of Connecticut is offering online training in Taxpayer Representation in cooperation. Trusted Reliable Experts.

CPA Master Tax X-IRS Agent 28 Yrs Exp Can Help. Return must be filed January 5 -. Speak With A Proven Trusted Screened IRS Levy Specialist Now To Get Your Levy Released.

Ad Access IRS Tax Forms. Review Comes With No Obligation. Ad IRS Tax Levy Help Is A Phone Call Away.

How Much Of Your Income Can The Irs Take In A Tax Garnishment Fidelity Tax

Irs Cp 508c Notice Of Certification Of Your Seriously Delinquent Federal Tax Debt To The State Department

Irs Cp 79 We Denied One Or More Credits Claimed On Your Tax Return

What Is The Difference Between A Tax Lien And A Tax Levy

Saving Money On Taxes Is Easy When You Know The Tax Laws And Rules Reduce Your Tax Liability And Get Closer To Y Debt Relief Programs Back Taxes Help Tax Help

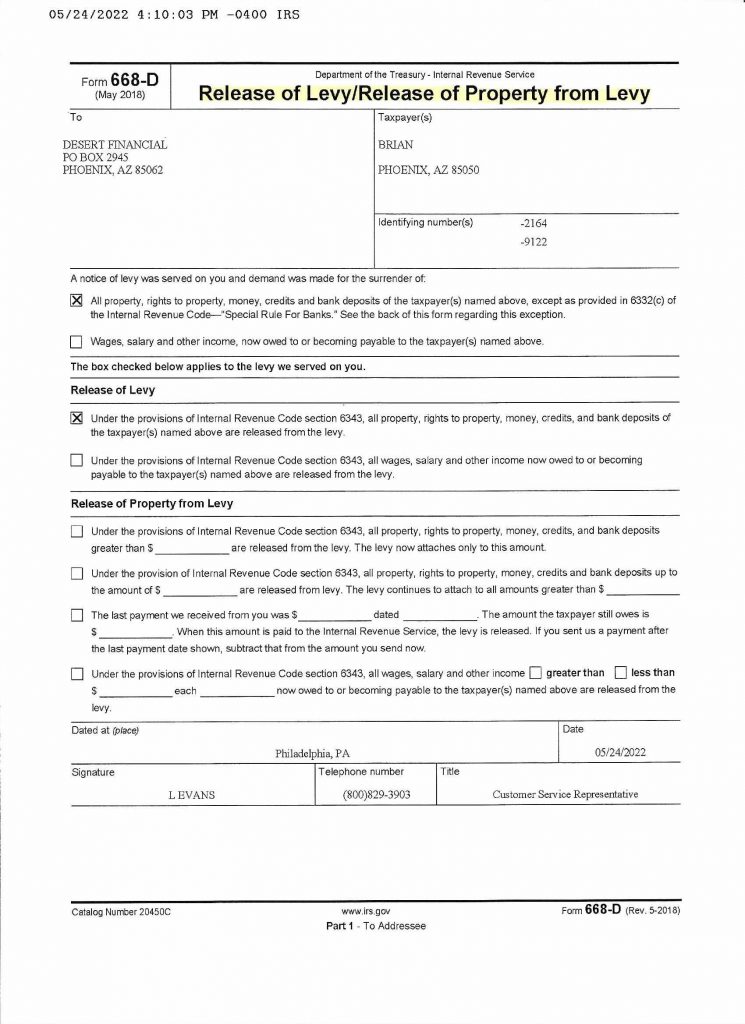

Irs Bank Levy Release Tax Levy Rush Tax Resolution

We Solve Tax Problems Debt Relief Programs Tax Debt Irs Taxes

Irs Tax Debt Relief Forgiveness On Taxes

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

Irs Tax Levy Tax Law Offices Of David W Klasing

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

Irs Taxes Lakeview Michigan Mmfinancial Org 800 856 5401 Irs Taxes Tax Debt Internal Revenue Service

Irs Has Restarted The Income Tax Levy Program

Irs Cp134r Federal Tax Deposit Ftd Refund

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Understanding A Tax Lien And How To Get It Removed Irs Taxes Tax Attorney Tax Debt Relief